santa clara county property tax calculator

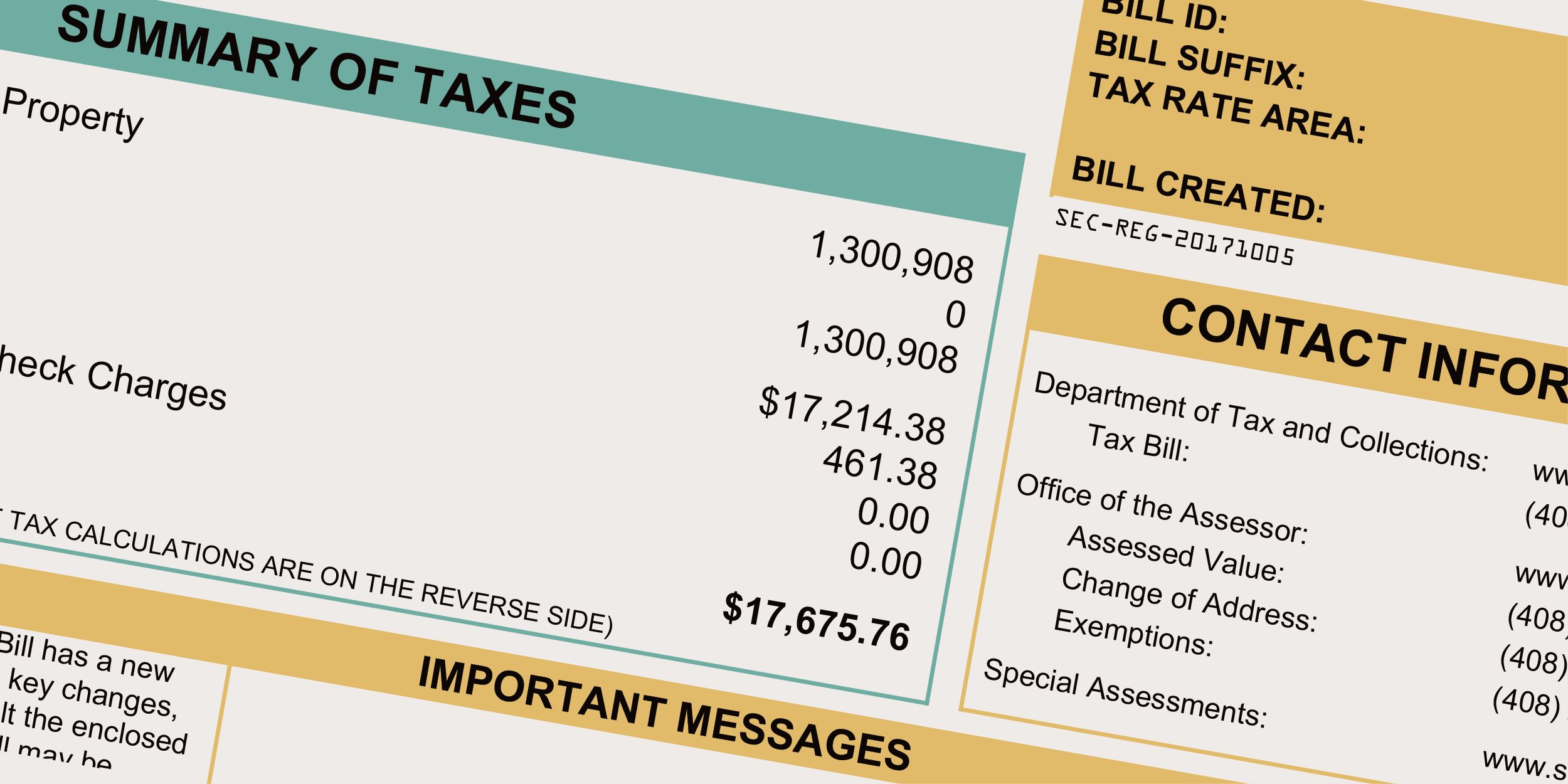

SCC Tax The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022. A reasonable effort has been made to ensure the accuracy of the data provided.

County of Santa Clara.

. Therefore the New Taxable Value on the date of transfer is the factored base year value of 250000. The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022. The principal residence has a full cash value of.

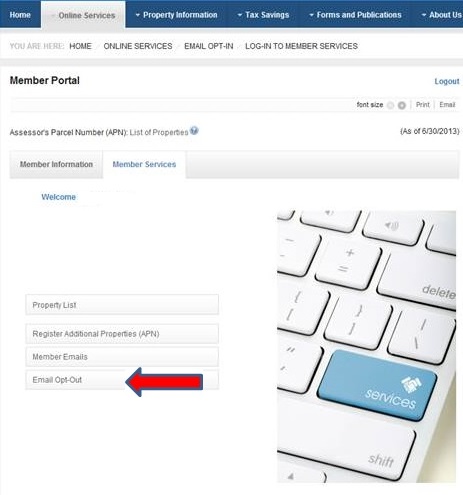

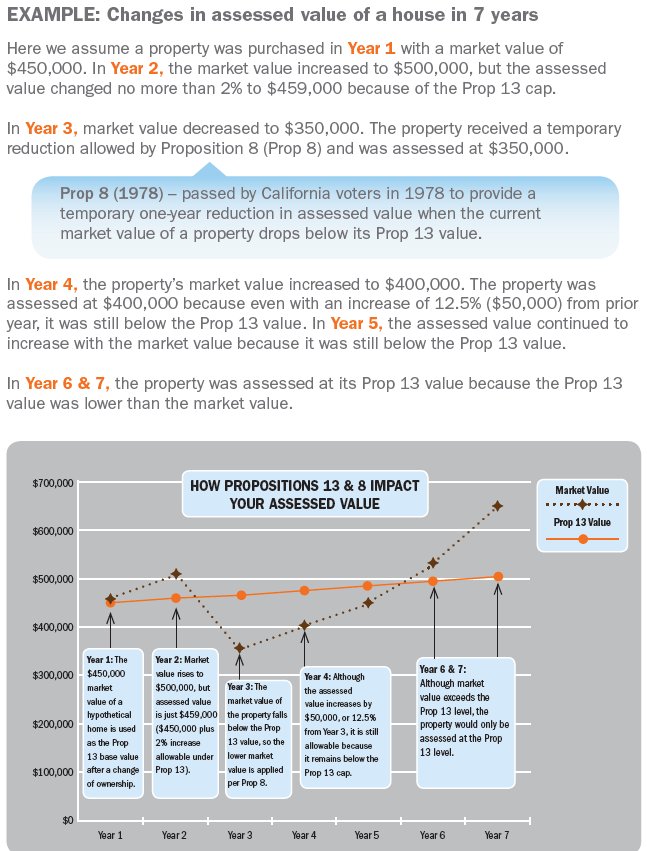

The Prop 19 Estimator provides estimates of supplemental assessment s of a hypothetical transfer of ownership of principal residence from one county to another. This service has been provided to allow easy access and a visual display of County Assessment information. Santa Clara County collects on average 067 of a propertys.

Santa Clara County collects on average 067 of a propertys. Finally the Tax Collector prepares property tax bills based on the County Controllers calculations distributes the bills and then collects the taxes. Our Santa Clara County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average.

The bills will be available online to be viewedpaid on the same day. Owners must also be given an appropriate notice of rate. San Jose California 95110.

The average effective property tax rate in Santa Clara County is 079. But because the median home value in Santa Clara County is a whopping 664100 the median property tax amount in the county is 5275. 408 299 5500 Phone 408 297 9526 Fax The Santa Clara County Tax Assessors Office is located in San Jose California.

The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of 701000. A Baird Driskell Community Planning project built and managed by Electricbaby. All real estate not falling under exemptions should be taxed evenly and uniformly on a single current market value basis.

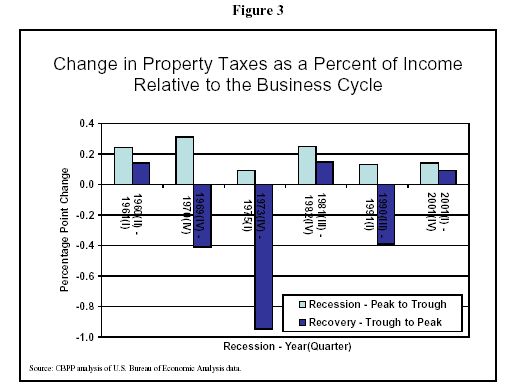

Santa Clara County Property Taxes Range Santa Clara County Property Taxes Range Based on latest data from the US Census Bureau You May Be Charged an Unfair Property Tax. The Prop 19 Estimator provides estimates of both the supplemental assessment s and the subsequent regular roll assessment due to a hypothetical transfer of ownership of. Additional Dwelling Unit Calculator.

The Santa Clara County California sales tax is 900 consisting of 600 California state sales tax and 300 Santa Clara County local sales taxesThe local sales tax consists of a. The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of 701000. SCC Tax The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022.

Neither the County Board of. The bills will be available online to be viewedpaid on the. The bills will be available online to be viewedpaid on the same day.

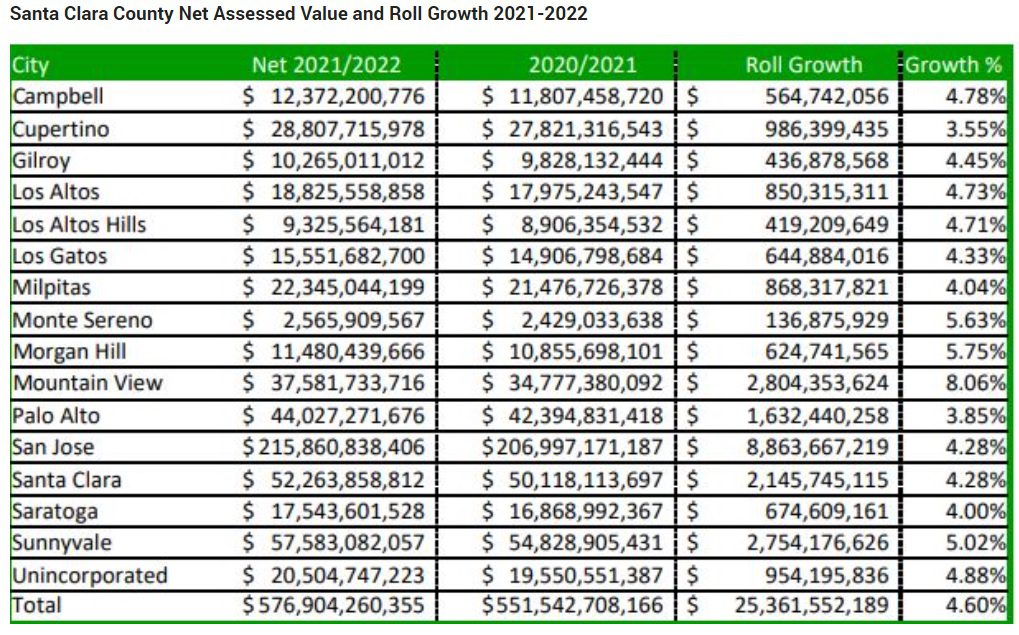

Santa Clara County Sees Increase In Value Of Taxable Properties San Jose Spotlight

Santa Clara County Ca Property Tax Calculator Smartasset

Transfer Tax Calculator 2022 For All 50 States

Scc Dtac By County Of Santa Clara

San Diego County Ca Property Tax Rates In 2022 2023

Property Tax Rate Book Controller Treasurer Department County Of Santa Clara

Property Taxes Department Of Tax And Collections County Of Santa Clara

Santa Clara County On Twitter Sccgov Dept Of Tax And Collections Issues Announcement About Prepayment Of Propertytaxes Accepting Current Years S 2nd Installment Due April 10 2018 But Not Prepayment Of Future 2018 2019

Californians Adapting To New Property Tax Rules City National Bank

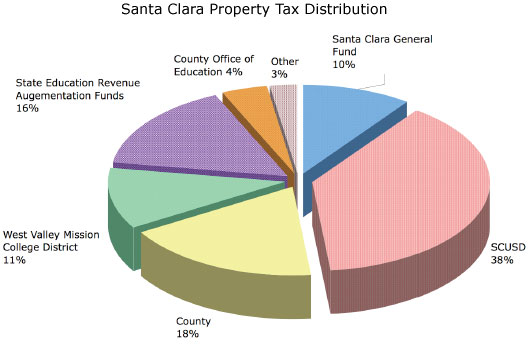

City S General Fund Gets Small Share Of Santa Clara Property Tax Dollars The Silicon Valley Voice

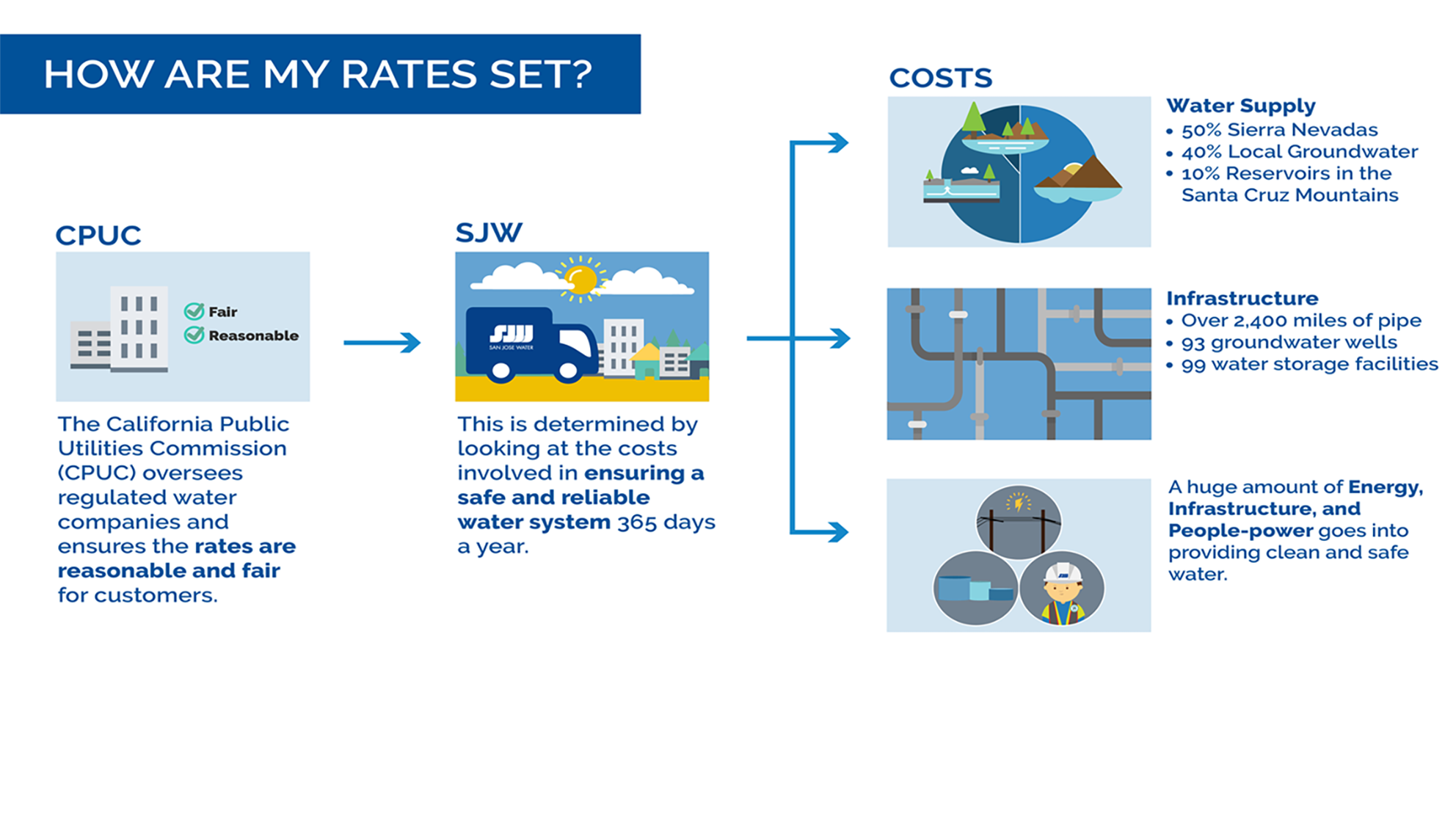

Valley Water Rate Increase July 1 2021 San Jose Water

Property Tax Calculator How Property Tax Works Nerdwallet

What You Should Know About Santa Clara County Transfer Tax

What You Should Know About Santa Clara County Transfer Tax

Santa Clara County Property Taxes Due Date Ke Andrews

Property Tax California H R Block

Market Value Decline Property Tax Relief Ccsf Office Of Assessor Recorder